Pre tax contribution calculator

You must enter the amounts of your. Actual results may vary.

Roth Ira Calculator Roth Ira Contribution

Our Salary sacrifice calculator helps you to compare the effect on take home pay and super contributions by making additional super contributions using two different methods ie as a.

. Thats where our paycheck calculator comes in. On the other hand to make a 6000 Roth IRA. Free inflation-adjusted IRA calculator to estimate growth tax savings total return and balance at retirement of Traditional Roth IRA SIMPLE and SEP IRAs.

Step 2 Figure out the rate of interest that would be earned. For example a 6000 contribution to a pre-tax retirement plan is an untaxed contribution and therefore its tax- deductible. The results provided are an estimate based on the information provided in the input fields.

When you make a pre-tax contribution to your. Its easy to get started boosting your super. S are two of the most popular tax.

You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit. In general contributions to retirement accounts can be made pre-tax as in a 401k or a traditional IRA. For the pre-tax 457 this is the sum of two parts.

A 457 plan contribution can be an effective retirement tool. The primary tax advantage is that employees contribute to the retirement plan with money that hasnt been hit with payroll taxes yet -- that is they make pre-tax contributions. For some investors this could prove.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. Roth 401 k contributions allow you to contribute to your 401 k account on an after-tax basis and pay no taxes on qualifying distributions when the money is withdrawn. Start pre-tax contributions by contacting your HR Payroll area.

This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with projections early withdrawals or maximizing employer match. After tax total at retirement.

Actual Cost Of Pre-Tax Contributions. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Whether you participate in a 401 k 403 b or 457 b program the.

The super co-contribution calculator is a tool to help individuals including the self-employed estimate their co-contribution entitlement and eligibility based on information provided about. One way to invest that money is to just put say 200. Divide Saras annual salary by the number of times shes paid during the year.

Let them know how much youd like to contribute each pay period. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. Contributions to a traditional IRA qualify for a tax deduction for the year the.

For the Roth 457 this is the total value of the account. Her gross pay for the period is 2000 48000 annual. Calculate the employees gross wages.

So for example if your salary is 1000 a week and the tax rate is 25 you bring home 750 a week after taxes. The Roth 457 plan allows you to contribute to your 457 account on an after-tax basis and pay no taxes on qualifying. S exist for people.

1 The value of the account after you pay income taxes on all. Also a fixed periodical amount will be invested in the 401 k Contribution which would be a maximum of 19000 per year. Any contribution made to a designated pension plan retirement account or other tax deferred investment vehicle where the contribution is made.

Traditional Vs Roth Ira Calculator

Different Types Of Payroll Deductions Gusto

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Paycheck Calculator Take Home Pay Calculator

Pre Tax Profit Margin Formula And Ratio Calculator Excel Template

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Paycheck Calculator Take Home Pay Calculator

Traditional Vs Roth Ira Calculator

After Tax Contributions 2021 Blakely Walters

Pre Tax Income Ebt Formula And Calculator Excel Template

Pre Tax Income Ebt Formula And Calculator Excel Template

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

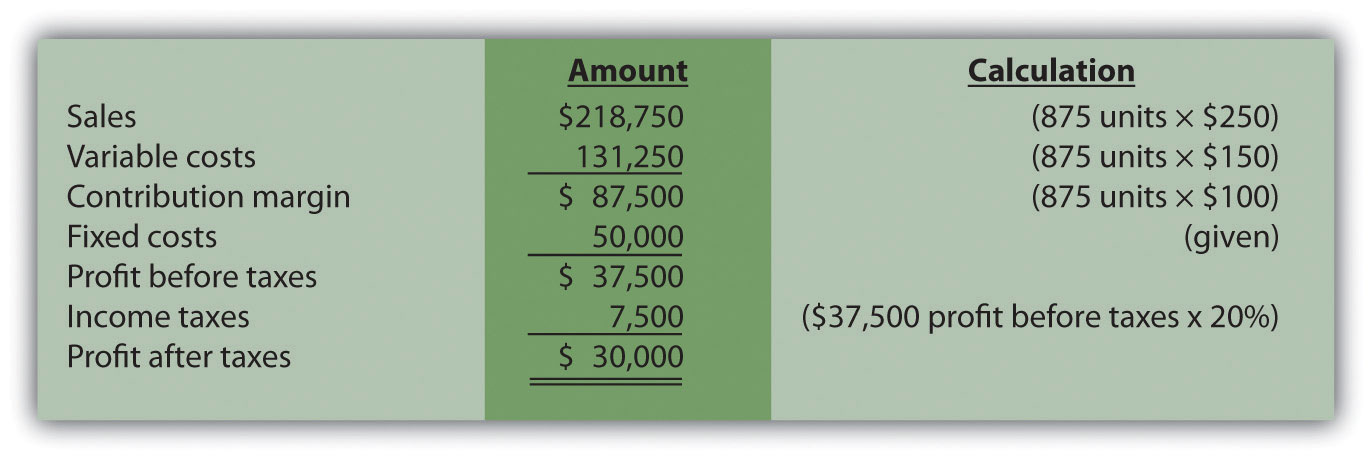

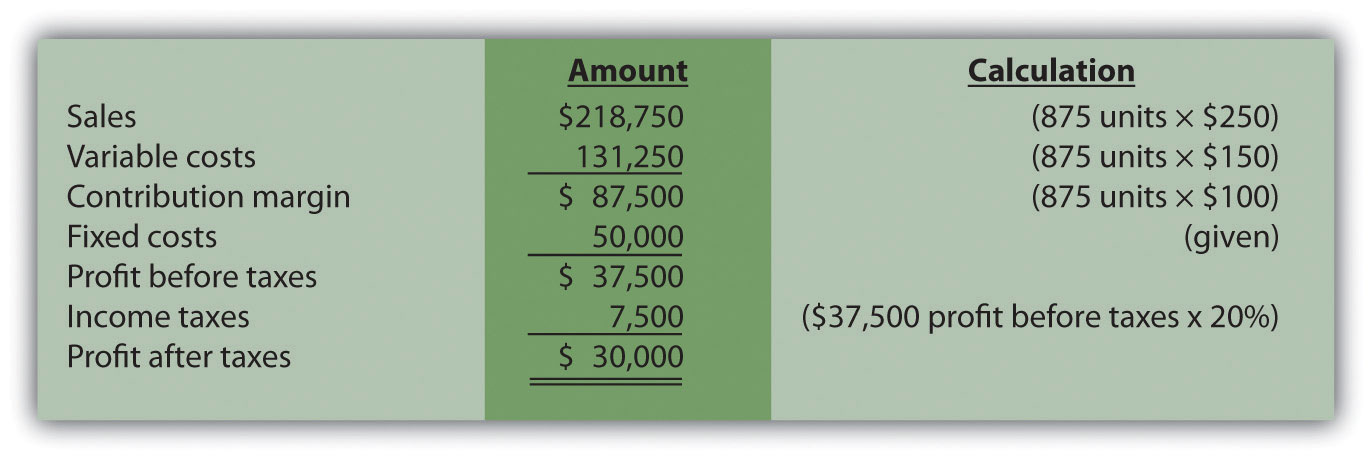

Income Taxes And Cost Volume Profit Analysis