Salary breakup calculator online

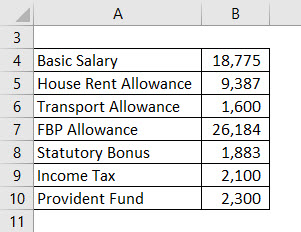

It is a monthly statement that consists of the details about all the components of the salary. Salary Basic DA if part of retirement benefit Turnover based Commission.

Download Salary Breakup Report Excel Template Exceldatapro Breakup Payroll Template Salary

If you are looking to automate you Organisations CTC salary structure in excel then you can download PayHRs Latest Excel CTC Salary Calculator in which you can customize your cost to company as per your company policy.

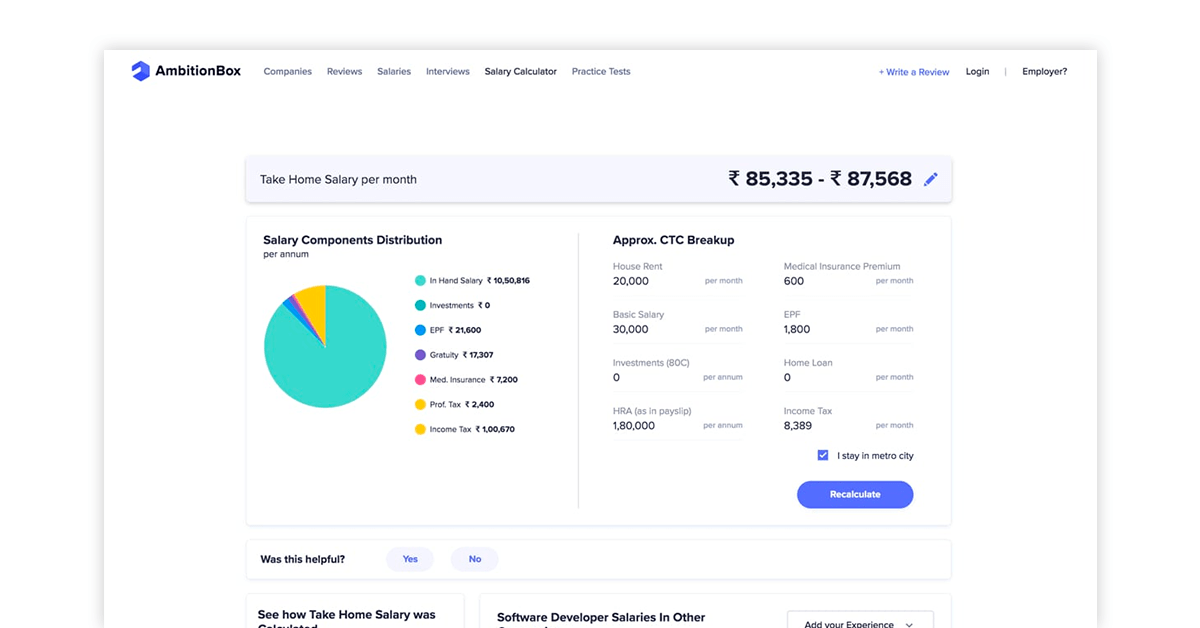

. Yearly Monthly Break Up of Gross Salary Basic 30 HRA 20 City Compensatory All. A monthly salary calculator or CTC breakup calculator is an online tool that calculates your in-hand salary based on cost to the company CTC or the total salary package after all the deductions. It provides the detailed structure of the salary at a glance.

A Payslip or Salary Slip is a document provided by the employer to all the employees. 1 Enter the Annual CTC amount for a specific employee. Annual income tax approximately Rs.

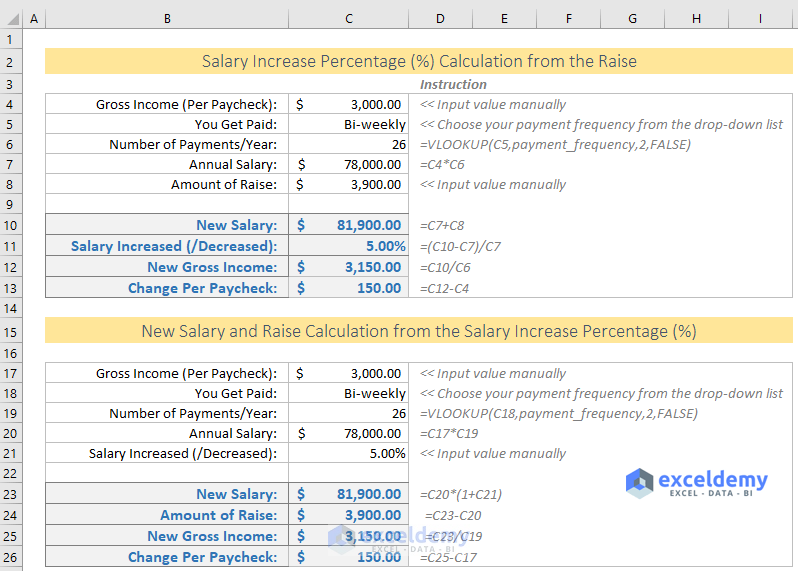

930000 48600 881400 Take Home Salary. All you need is to enter the year CTC and monthly basic pay and the calculator will default all the parameters like EPF Gratuity Standard deduction HRA and Professional Tax before it calculates in hand salary. Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions are the sum of PF ESI and PT etc.

Take Home Salary Calculation. B 40 of Salary 50 if house situated in Mumbai Calcutta Delhi or Madras c Rent paid minus 10 of salary. Its free to sign up and bid on jobs.

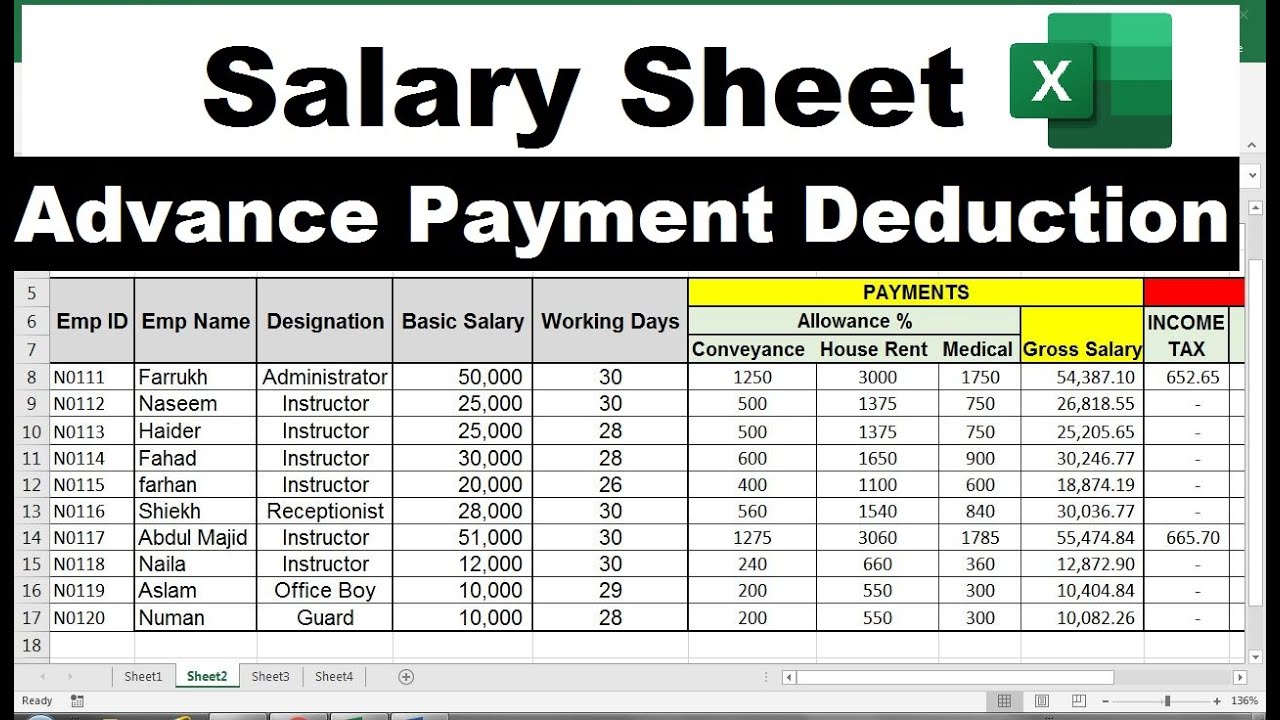

Annual income tax approximately Rs. 30 Conveyance Rs800 per month Special Allowance Balance Yearly Grand Totals Monthly Gross Salary 200000 16667 Basic 60000 5000 HRA. 1800 each of employee and employer contribution per.

It gives you a better picture of what constitutes the salary. You may calculate your salary. It will show you different components of salary and various deductions such as Provident fund professional tax employee insurance and the take.

Professional tax EPF Employee EPF Employer Employee Insurance Total Deductions. 2 Select Compliance Settings as per your organizations applicability. All elements of the salary breakup including the deductions are enlisted in a payslip or a salary slip.

This is how the monthly salary calculator in India is used. Try a free demo. All incomes from salary are taxable under the Income Tax Act 1961 subject to deductions and exemptions as provided by law.

This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. Asanify offers HR and Payroll Accountants an online salary calculator to calculate the net salary of the employees based on their CTC. Ad Benchmark pay with confidence using ERIs salary survey data.

The net annual take-home salary as per old tax regime will. A Actual HRA Received. The breaking down of salary into individual separate items or various components is referred to as Salary breakup.

Take Home Salary Calculator India has been updated for the financial year 2020-2021 Take home salary calculator is also referred in india as in hand salary calculater. Compare wage differentials for 9000 locations in the US Canada and Europe. 2 for the income above 50284.

All the variable fields amounts limits and the percentages can be customized based on your needs. 78000 as per new tax. Search for jobs related to Online salary breakup calculator or hire on the worlds largest freelancing marketplace with 20m jobs.

Rules for calculating payroll taxes. Take Home Salary Gross Salary - Income Tax - NI - Deductions Child Care Vouchers Salary Sacrifice Employee Pension Contribution Component. TDS is calculated on Basic Allowances Deductions 12 IT Declarations Standard deduction Standard.

Least of the following is exempt. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Total Deductions Gross Pay Take Home Salary.

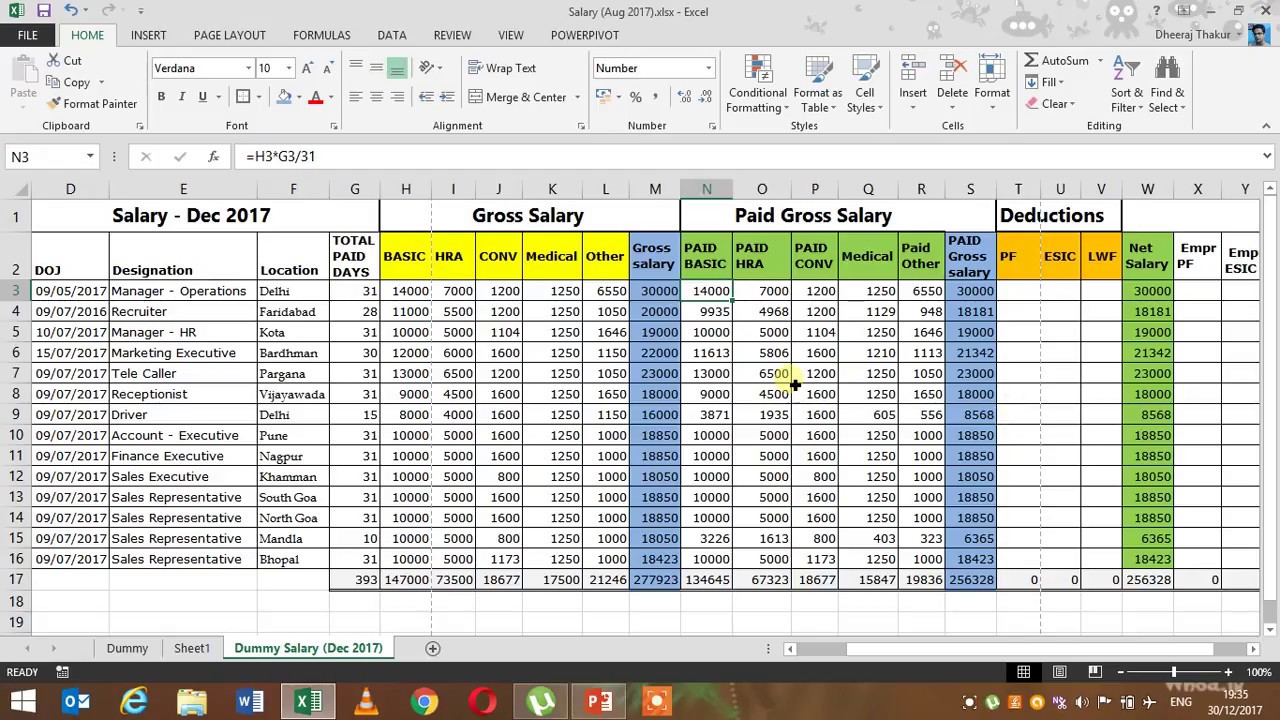

28475 as per old tax. I have attached salary break Up calculator in excel format. All other pay frequency inputs are assumed to be holidays and vacation days adjusted values.

2400 21600 21600 3000 48600. You can calculate an employees salary in three easy steps. Online CTC Calculator.

Considerations in our Salary Calculator. Take home salary is calculating by deducting income tax NI and other salary deductions.

Excel Ctc Calculator For Hr Professionals Payhr

How To Calculate Salary Increase Percentage In Excel Free Template

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Ctc Salary Calculator Recommended Compensation Asanify

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Salary Breakup Calculator Excel 2022 Salary Structure Calculator

Salary Breakup Calculator Excel 2022 Salary Structure Calculator

Salary Formula Calculate Salary Calculator Excel Template

Salary Calculator In Hand Salary Calculator Great Learning

Salary Sheet In Excel With Formula Salary Sheet Sample Youtube

Take Home Salary Calculator India Excel 2021 22 Moneyjigyasu

Take Home Salary Calculator India Excel 2021 22 Moneyjigyasu

Salary Calculation In Excel Payroll In Excel Tutorial Youtube

Salary Formula Calculate Salary Calculator Excel Template

10 Best Free Payroll Calculator In India Fy 2021 22 Paycheck Calculator

Salary Formula Calculate Salary Calculator Excel Template